Deed of Trust Explained: Arizona Real Estate

Introduction

For real estate investors in Arizona, understanding deeds of trust is crucial for successful property transactions and investment strategies. Unlike many states that primarily use mortgages, Arizona predominantly utilizes deeds of trust as the primary security instrument in real estate financing. This unique aspect of Arizona real estate law creates both opportunities and obligations that savvy investors must comprehend. Whether you're purchasing your first investment property or expanding your portfolio, knowing how deeds of trust function in Arizona can significantly impact your success and protect your investments.

Understanding Deeds of Trust in Arizona

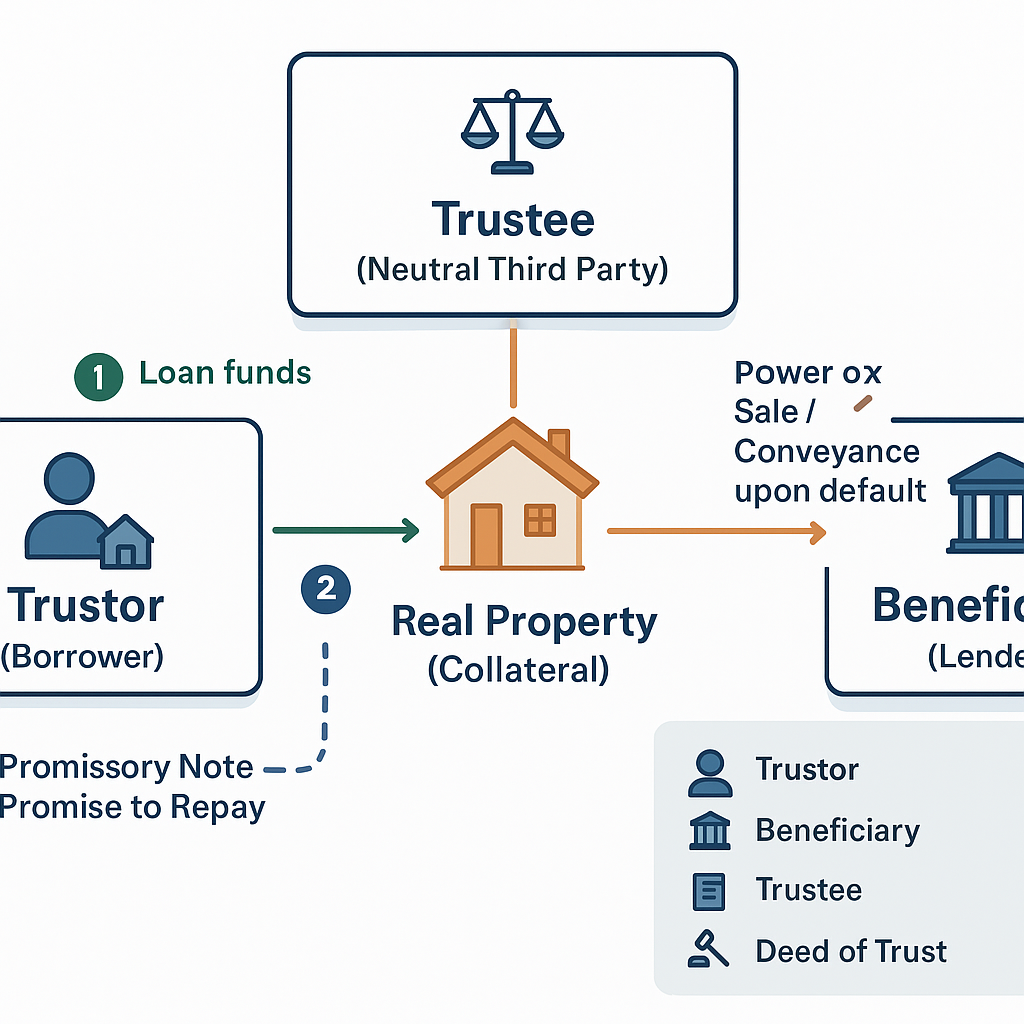

A deed of trust in Arizona involves three parties: the trustor (borrower), the beneficiary (lender), and the trustee (typically an escrow company or attorney). This three-party arrangement differs significantly from traditional mortgages, which only involve the borrower and lender. Under Arizona Revised Statutes § 33-805, deeds of trust serve as security instruments for the performance of contracts, essentially functioning as an alternative to conventional mortgages.

Key Components and Structure

The deed of trust transfers the legal title of a property to the trustee, who holds it as security for the loan until the debt is fully paid. This arrangement creates a unique legal framework where the trustee acts as a neutral third party, holding the power of sale if the borrower defaults. According to Arizona law, the document must contain specific elements to be valid, including:

- A clear description of the property being used as security

- The loan amount and terms of repayment

- The power of sale clause

- Assignment of rents (if applicable)

- The rights and obligations of all parties involved

The trustee's role is particularly important, as they have the authority to initiate non-judicial foreclosure proceedings if the borrower defaults on their obligations.

Power of Sale and Foreclosure Process

One of the most significant advantages of Arizona deeds of trust is the power of sale clause, which enables non-judicial foreclosure. Under A.R.S. § 33-807, if a borrower defaults, the beneficiary can choose between two foreclosure options: judicial foreclosure (similar to mortgage foreclosure) or non-judicial foreclosure through the trustee's power of sale.

Non-Judicial Foreclosure Timeline

The non-judicial foreclosure process in Arizona typically moves much faster than judicial foreclosure. When a default occurs, the process generally follows these steps:

The trustee records a Notice of Trustee's Sale and must wait at least 90 days before conducting the sale. During this period, they must:

- Mail notice to all interested parties

- Post notice on the property

- Publish the notice in an approved newspaper

- Provide the trustor opportunity to reinstate the loan

This streamlined process typically concludes within 90-120 days, making it an efficient remedy for lenders and creating opportunities for investors monitoring distressed properties.

Legal Rights and Protections

Arizona law provides specific protections for all parties involved in a deed of trust arrangement. The trustor retains important rights, including:

The right of reinstatement, allowing them to cure the default by paying all past-due amounts plus costs before the trustee's sale. They also maintain the right of redemption in judicial foreclosures, though this right doesn't apply to non-judicial trustee's sales. The beneficiary receives protection through the security interest in the property and the efficient non-judicial foreclosure option.

Practical Applications for Investors

For Arizona real estate investors, deeds of trust offer several strategic advantages. When purchasing properties, investors can often negotiate more favorable terms due to the lender's increased security and efficient default remedies. Additionally, investors can use deeds of trust when offering seller financing, providing better protection than traditional mortgages.

Common Mistakes to Avoid

Many investors underestimate the importance of proper documentation in deed of trust arrangements. Missing or incorrect information can invalidate the security instrument or create costly delays. Another common error is failing to understand the strict notice requirements for trustee's sales, which can void the entire foreclosure process if not followed precisely.

Pro Tips and Best Practices

Successful investors in Arizona maintain detailed records of all deed of trust documentation and payment histories. They also develop relationships with experienced trustees and title companies who understand local requirements. When acquiring properties through trustee's sales, thorough due diligence is essential, including title searches and property inspections, as these sales typically come with limited warranties.

Conclusion

Understanding deeds of trust is fundamental to successful real estate investing in Arizona. The efficiency of non-judicial foreclosure, combined with clear legal frameworks and protections, makes these instruments valuable tools for both lenders and investors. By mastering the intricacies of deeds of trust, investors can better protect their interests and capitalize on opportunities in the Arizona real estate market. Consider consulting with a qualified real estate attorney to ensure your investment strategy aligns with current Arizona laws and regulations.