Arizona Foreclosure Process: Complete Timeline for Investors

Introduction

For real estate investors in Arizona, understanding the foreclosure process represents both an opportunity and a responsibility. The Grand Canyon State's unique foreclosure landscape, primarily centered on non-judicial proceedings, creates distinctive dynamics for investors looking to acquire distressed properties. While foreclosures can be challenging for homeowners, they also present strategic opportunities for informed investors who understand the intricate timeline and legal requirements. Whether you're considering your first foreclosure investment or expanding your portfolio, mastering Arizona's foreclosure process is essential for making sound investment decisions and navigating transactions effectively.

The Pre-Foreclosure Phase

Initial Default Period

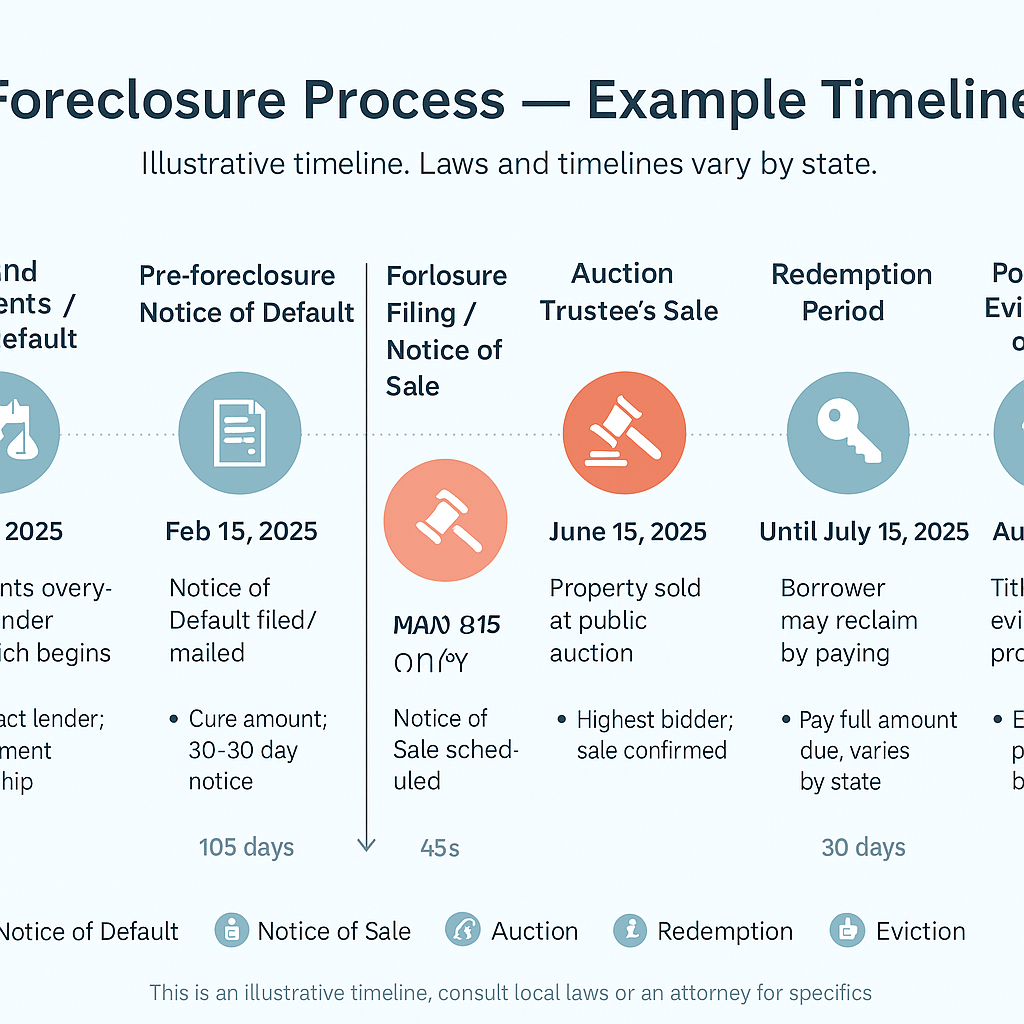

In Arizona, the foreclosure clock typically starts ticking when a borrower misses their first mortgage payment. However, most lenders won't initiate foreclosure proceedings until the borrower is at least 90 days delinquent. This creates a critical window of opportunity for investors to identify potential deals before formal proceedings begin.

Notice of Default Requirements

Once a borrower reaches serious delinquency, Arizona law requires lenders to send a Notice of Default (NOD) via certified mail. This formal document marks the official beginning of the pre-foreclosure period and must include specific information about the default amount, the property in question, and the borrower's rights. For investors, the NOD filing represents the first public record of a potential foreclosure opportunity.

Borrower Response Window

After receiving the NOD, borrowers have a legally mandated period to respond and potentially cure the default. During this time, they can:

- Pay the past-due amount and reinstate the loan

- Negotiate a loan modification with the lender

- Pursue a short sale

- Allow the foreclosure to proceed

This period typically lasts 90 days, creating a strategic window for investors to approach homeowners about potential solutions.

The Formal Foreclosure Process

Non-Judicial vs. Judicial Foreclosures

While Arizona allows both judicial and non-judicial foreclosures, approximately 90% of foreclosures in the state proceed through the non-judicial route. This preference stems from the faster timeline and lower costs associated with non-judicial proceedings. For investors, understanding this distinction is crucial as it affects both acquisition strategies and timeline expectations.

Notice of Trustee Sale Requirements

Following the initial 90-day period, if the default remains uncured, the lender must file and publish a Notice of Trustee Sale. This notice must appear in a newspaper of general circulation in the county where the property is located for four consecutive weeks. Additionally, the notice must be:

- Posted on the property itself

- Recorded with the county recorder's office

- Sent to the borrower via certified mail

- Made available to the public for review

The Auction Process

The trustee sale typically occurs between 90 and 120 days after the initial Notice of Default. Arizona law requires these auctions to be conducted between 9:00 AM and 5:00 PM at the county courthouse in the county where the property is located. Investors should note that Arizona requires all auction participants to have readily available funds, typically in the form of cash or certified funds.

Strategic Considerations for Investors

Due Diligence Requirements

Successful foreclosure investing in Arizona requires thorough due diligence. This includes:

A comprehensive title search to identify any liens or encumbrances that could affect the property's value or transferability. Most experienced investors work with local title companies to ensure nothing is missed during this critical phase.

Property condition assessment becomes particularly important in Arizona's climate. The state's extreme temperatures can cause significant property deterioration during vacant periods, making professional inspections crucial before bidding.

Timeline Management

The typical Arizona foreclosure timeline runs approximately 120-150 days from initial default to trustee sale. However, investors should build flexibility into their timelines, as various factors can extend this period:

- Bankruptcy filings by the homeowner

- Title issues requiring resolution

- Legal challenges to the foreclosure process

- Loan modification negotiations

Investment Strategies

For Arizona investors, several strategic approaches have proven successful:

Direct outreach to homeowners during the pre-foreclosure period often yields the best opportunities. This approach allows investors to potentially negotiate favorable terms while helping homeowners avoid a completed foreclosure.

Auction participation requires substantial preparation, including securing funds and completing thorough due diligence before the sale date. Successful auction investors typically maintain relationships with local title companies and contractors to expedite their analysis process.

Conclusion

Understanding Arizona's foreclosure timeline isn't just about knowing the legal requirements – it's about recognizing opportunities within each phase of the process. Successful investors combine this knowledge with careful due diligence and strategic planning to make informed decisions. Whether you're targeting pre-foreclosure opportunities or auction acquisitions, maintaining a thorough understanding of the process timeline is crucial for success in Arizona's foreclosure market. Consider working with local real estate attorneys and title companies to build a strong foundation for your foreclosure investment strategy.