What is a Warranty Deed in Arizona Real Estate?

Introduction

When purchasing investment property in Arizona, few documents carry as much weight as the warranty deed. This crucial legal instrument serves as the gold standard for transferring real estate ownership, providing buyers with the highest level of protection under Arizona law. For investors navigating the state's dynamic real estate market, understanding warranty deeds isn't just a legal formality—it's essential for protecting their investments and ensuring clean title transfers.

Whether you're purchasing a fix-and-flip property in Phoenix or acquiring a rental home in Tucson, the warranty deed represents your seller's strongest guarantee that the property title is clear and defensible. But what exactly does this document entail, and why should Arizona real estate investors pay particular attention to its provisions? Let's explore the comprehensive protections and specific requirements of warranty deeds in the Grand Canyon State.

Understanding Warranty Deeds in Arizona

Definition and Legal Basis

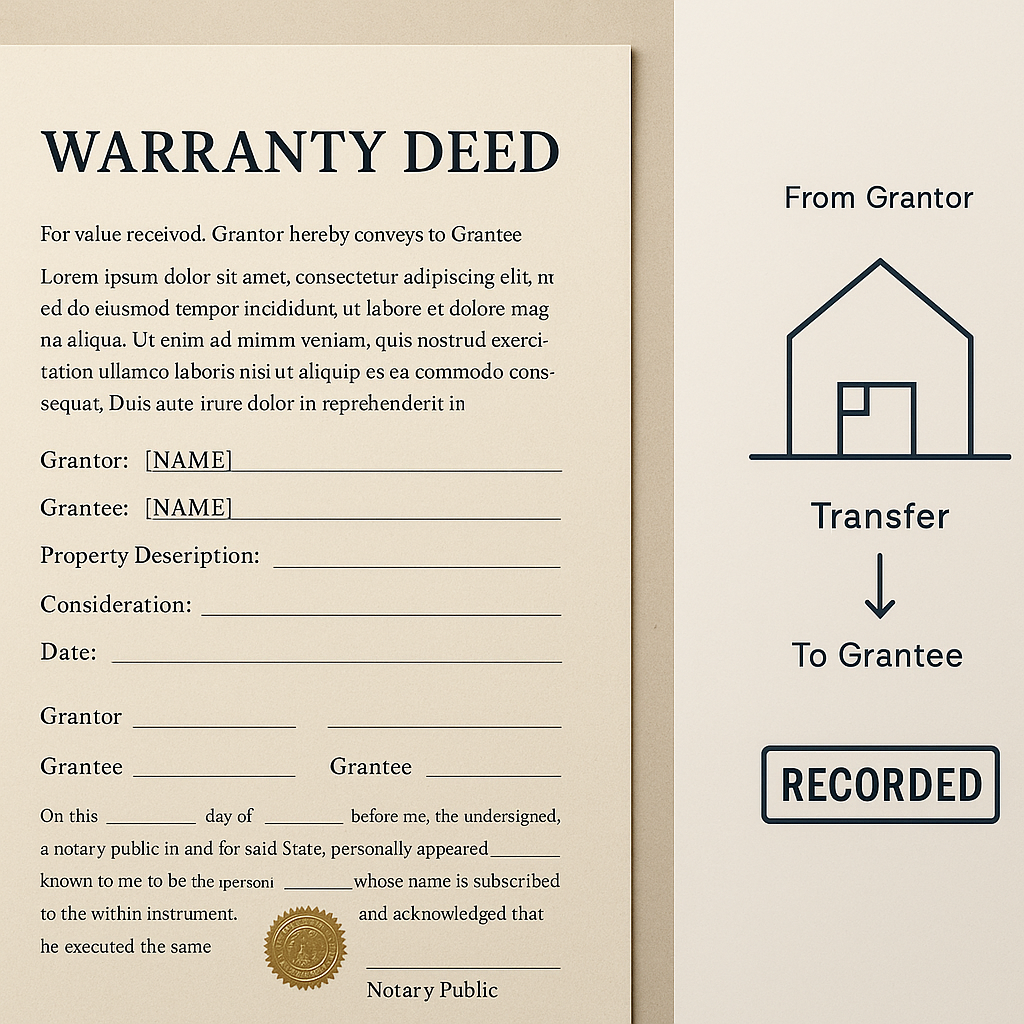

A warranty deed in Arizona is a legal document that transfers real property ownership while providing the buyer (grantee) with specific guarantees about the property's title. Under Arizona Revised Statutes §33-401, these deeds must be in writing and properly executed to transfer any estate of inheritance or freehold in lands. The deed essentially represents the seller's (grantor's) promise that they have the legal right to transfer the property and that no hidden claims or encumbrances exist.

Key Guarantees Provided

The warranty deed offers several crucial protections that make it particularly valuable for real estate investors. The grantor guarantees that they hold clear title to the property and have the right to transfer it. They also warrant that no undisclosed liens, encumbrances, or claims exist against the property, except those specifically mentioned in the deed. Perhaps most importantly, the grantor agrees to defend the title against any future claims that might arise, even from issues predating their ownership.

Legal Requirements for Valid Warranty Deeds

For a warranty deed to be legally valid in Arizona, it must contain several essential elements. The document must clearly identify both the grantor and grantee, provide an accurate legal description of the property, and include words of conveyance indicating the intent to transfer ownership. Additionally, the deed must be signed by the grantor in the presence of a notary public and recorded with the county recorder's office where the property is located.

Types of Warranty Deeds in Arizona

General Warranty Deed

The general warranty deed provides the most comprehensive protection for buyers. It guarantees against any title defects throughout the property's entire history, not just during the grantor's period of ownership. This type of deed is most common in Arizona residential real estate transactions and is particularly favored by cautious investors seeking maximum protection.

Special Warranty Deed

A special warranty deed offers more limited protection, with the grantor only guaranteeing against claims that arose during their ownership period. While less comprehensive than a general warranty deed, this instrument still provides significant protection and is often used in commercial real estate transactions or when the seller cannot verify the property's complete history.

Practical Applications for Investors

Real estate investors in Arizona should approach warranty deeds strategically. When purchasing investment properties, insist on a general warranty deed whenever possible, particularly for residential acquisitions. This provides the strongest protection against potential title issues that could impact your investment's value or marketability.

Common Mistakes to Avoid

One frequent mistake investors make is failing to thoroughly review the warranty deed's exceptions and reservations. These clauses can significantly impact property rights and future development potential. Another critical error is not ensuring proper recording of the deed immediately after closing. Delays in recording can create gaps in the chain of title and potentially expose the investment to competing claims.

Some investors also mistakenly assume that a warranty deed eliminates the need for title insurance. While warranty deeds provide important protections, they should be viewed as complementary to, not replacements for, comprehensive title insurance coverage.

Pro Tips and Best Practices

Experienced Arizona investors know to carefully review the property's legal description in the warranty deed against current surveys and title reports. They also maintain complete documentation of the transaction, including supporting evidence of any title clearance efforts. Working with a qualified real estate attorney to review warranty deeds before closing can help identify potential issues before they become problems.

Conclusion

A warranty deed represents one of the most important protections available to Arizona real estate investors. By understanding its provisions, requirements, and limitations, investors can better protect their interests and ensure smooth property transfers. Whether you're just starting in real estate investing or expanding your portfolio, making informed decisions about warranty deeds is crucial to your success in the Arizona market. Consider consulting with a qualified real estate attorney to review your specific situation and ensure your investments are properly protected through appropriate deed selection and execution.