Who Is MagicList For? A Complete Guide to Our Target Audience

Table of Contents

- Introduction

- The Short Answer

- New Foreclosure Investors

- Active Wholesalers

- Fix and Flip Operators

- Creative Finance Specialists

- Buy-and-Hold Investors

- Small Investment Firms

- Who MagicList Is NOT For

- Geographic Requirements

- Success Profiles: Real Stories

- How to Know If MagicList Is Right for You

- Conclusion

Introduction

"Is MagicList right for me?"

It's the most common question we get from potential customers. And it's a good question—because MagicList isn't designed to be everything to everyone.

We built MagicList for a specific type of real estate investor: someone who is actively closing foreclosure deals in Arizona (specifically Maricopa County) and wants to find high-equity opportunities before the competition.

But that definition still leaves a lot of ambiguity. In this comprehensive guide, we'll break down exactly who MagicList serves best, including detailed profiles of our core user personas, real-world use cases, and honest assessments of who should probably look elsewhere.

The Short Answer

MagicList is ideal for:

✅ Real estate investors focused on foreclosures and pre-foreclosures

✅ Investors operating in Maricopa County, Arizona (Phoenix metro)

✅ Wholesalers doing 3-15 deals per month

✅ Fix-and-flip operators buying 2-5+ properties per month

✅ New investors looking for their first 1-5 deals

✅ Creative finance specialists working subject-to and seller finance deals

✅ Anyone frustrated with Batch Leads' generic approach

✅ Investors who want pre-scored, skip-traced leads without manual filtering

MagicList is NOT ideal for:

❌ Investors focused on non-foreclosure strategies (absentee owners, probate, etc.)

❌ Investors operating outside Arizona (for now)

❌ Large institutional buyers with existing data pipelines

❌ Investors who only buy at auction (we focus on pre-auction opportunities)

❌ People "just browsing" without intent to close deals

Now let's dive deep into each user persona.

New Foreclosure Investors

Profile Overview

Experience Level: 0-2 closed deals

Monthly Deal Goal: 1-3 deals

Primary Pain Point: Information overload and lack of confidence in deal evaluation

Budget: Limited capital, needs affordable entry point

Who You Are

You're either:

- Brand new to real estate investing, specifically interested in foreclosures

- Have closed 1-2 wholesale or flip deals and want to scale

- Transitioning from other investing strategies into foreclosures

- Have capital to deploy but need deal flow

You understand that foreclosures can be profitable, but you're overwhelmed by:

- Too much data (Batch Leads has thousands of properties—where do you start?)

- Complex legal terminology (What's the difference between DOT and NS?)

- Risk assessment (How do you know if a deal is good?)

- Skip tracing costs (Should you pay $0.15/lead for 500 properties?)

Why MagicList Works for You

1. The "New Investor Bundle Under $200K" List

We created this list specifically for new investors. Every property in this list:

- Is priced under $200K (manageable first deal)

- Has 30%+ equity (built-in safety margin)

- Has a clear title situation (no complex liens)

- Includes skip-traced contact data (phone/email)

- Is scored A/B/C so you know where to start

This eliminates the "where do I begin?" paralysis.

2. Pre-Qualified Leads = Confidence

When you download the New Investor Bundle, you're not getting 500 random properties. You're getting 15-30 properties that:

- We've already verified fit your criteria

- We've already enriched with assessor data

- We've already scored based on opportunity quality

- We've already skip-traced for contact info

You can focus on making calls and evaluating deals, not filtering data.

3. Affordable Entry Point

Subscription pricing starts at $49-79/month per list. That's less than:

- One skip tracing bill on Batch Leads ($75 for 500 leads)

- One month of Batch Leads platform access ($149/month)

- One decent lunch for two

For the cost of one night out, you get unlimited access to pre-qualified, skip-traced foreclosure leads updated every 6 hours.

4. Learn As You Go

Every property report includes 28 data points. As you review properties, you'll learn:

- What good equity positions look like

- How to spot motivated sellers (owner-occupied properties)

- How to evaluate property types and conditions

- What loan types are easier to work with

MagicList is an educational tool disguised as a lead generation platform.

Real Success Story: James R.

Background: New investor, closed first wholesale deal after 6 months of trying

Before MagicList:

- Using Batch Leads, spending 10+ hours/week filtering

- Paid $150 for skip tracing 1,000 properties

- Called 300+ leads, most were not good fits

- Felt like he was "throwing spaghetti at the wall"

After MagicList:

- Subscribed to "New Investor Bundle Under $200K"

- Downloaded 22 properties (all pre-scored A/B)

- Called 22 properties over 2 weeks

- Got 3 motivated sellers

- Closed 1 deal (wholesale, $8,500 assignment fee)

His quote: "I closed my first deal in 3 weeks using the New Investor Bundle. The A/B/C scoring helped me focus on the best opportunities instead of wasting time on junk leads. I actually felt confident making calls because I knew the data was good."

Is This You?

You should use MagicList if:

- You're committed to closing foreclosure deals (not just learning)

- You're willing to make 50-100 calls to close your first deal

- You have 5-10 hours per week for acquisitions

- You're operating in Maricopa County

- You want clear guidance on where to start

You should NOT use MagicList if:

- You're "tire-kicking" without intent to close

- You want to browse thousands of properties without focus

- You're not willing to make cold calls

- You need nationwide coverage

- You're not ready to deploy capital (wholesale or purchase)

Active Wholesalers

Profile Overview

Experience Level: 10+ closed deals

Monthly Deal Goal: 5-15 wholesale assignments

Primary Pain Point: Consistent deal flow and early access to opportunities

Budget: $200-500/month on lead generation

Who You Are

You're an active wholesaler in the Phoenix metro area:

- You've closed 10+ wholesale deals

- You're doing 5-15 deals per month currently

- You have a buyers list of 50-200 cash buyers

- You have systems for acquisitions, dispositions, and deal management

- You're probably using Batch Leads or a similar platform

- You're frustrated with lead quality and competition

Your biggest challenges:

- Everyone calls the same leads. By the time you see a foreclosure on Batch Leads, 10 other wholesalers have already called.

- Skip tracing costs add up. At $0.15/lead, calling 2,000 leads per month costs $300 just for phone numbers.

- Filtering takes forever. You spend 10-15 hours per week setting filters, exporting, and cleaning data.

- Deal flow is inconsistent. Some weeks you get 3 deals, some weeks you get zero.

Why MagicList Works for You

1. 3-6 Month Early Warning

This is the game-changer for wholesalers: We track properties 3-6 months before they show up on Batch Leads.

How:

- We monitor Substitution of Trustee (ST) filings

- ST filings typically occur 45 days before Notice of Trustee Sale (NTS)

- We also use predictive models to identify pre-pre-foreclosure properties

- You're calling distressed sellers before anyone else knows they're distressed

The Competitive Advantage:

Month 1: MagicList identifies delinquent taxes and high LTV

Month 2: Substitution of Trustee filed → MagicList alerts you

Month 3: You make contact, build relationship

Month 4: Notice of Trustee Sale filed → Batch Leads users see it now

Month 5: You've already negotiated and have the property under contract

By the time your competitors see the deal, you've already closed it.

2. The "High-Equity Cash Cows" List

This is the most popular list for active wholesalers:

- 50%+ equity positions

- All property types (SFR, condos, multi-family)

- Owner-occupied preferred (motivated sellers)

- Market value $150K-$500K

- Updated every 6 hours

These are properties with enough equity to:

- Offer a fair price to the seller

- Build in your wholesale fee ($5K-15K)

- Leave meat on the bone for your buyer

3. FREE Skip Tracing = Predictable Costs

At 5-15 deals per month, you're calling 500-1,500 leads per month.

With Batch Leads:

- Platform: $149/month

- Skip tracing: $250-450/month (at $0.15/lead)

- Total: $399-599/month

With MagicList:

- Subscribe to 2-3 lists: $129-199/month

- Skip tracing: $0 (included)

- Total: $129-199/month

Savings: $200-400/month

Plus: No more rationing skip traces or second-guessing which leads are worth $0.15.

4. A/B/C Scoring Saves Time

You don't have time to call 1,500 leads. You need to prioritize.

MagicList's A/B/C scoring tells you:

- A-Grade (Top 20%): Call these immediately

- B-Grade (Next 30%): Call if A's don't convert

- C-Grade (Next 50%): Call if you have extra time

This turns a 1,500-lead list into:

- 300 A's (must-call immediately)

- 450 B's (follow up next)

- 750 C's (bulk SMS or skip for now)

You're focusing your calling time on the highest-probability deals.

Real Success Story: Marcus T.

Background: Phoenix wholesaler, 8-12 deals/month

Before MagicList:

- Using Batch Leads for 2+ years

- Spending $400+/month on platform + skip tracing

- 15 hours/week filtering and qualifying data

- Feeling like "everyone calls the same leads"

After MagicList:

- Subscribed to "High-Equity Cash Cows" + "Substitution of Trustee" lists

- Cut data management time from 15 hours/week to 30 minutes/week

- Started calling leads 4-6 weeks before competitors

- Increased deal flow by 40% (from 8/month to 11/month average)

- Saves $200/month on skip tracing

His quote: "I was spending 15 hours a week on Batch Leads trying to find good foreclosure deals. MagicList cut that to zero. The lists are already filtered exactly how I need them, and the skip tracing alone saves me $200/month. Plus, I'm calling leads 6 weeks before they show up on other platforms. It's not even fair."

Is This You?

You should use MagicList if:

- You're doing 5+ wholesale deals per month

- You have systems in place (CRM, buyers list, dispositions)

- You're spending $300+ per month on lead generation currently

- You want first-mover advantage on foreclosure opportunities

- You're frustrated with Batch Leads' quality and competition

You should NOT use MagicList if:

- You're focused on non-foreclosure lead types

- You operate outside Maricopa County

- You're vertically integrated with your own data team

- You prefer to build your own filtering systems

Fix and Flip Operators

Profile Overview

Experience Level: 5+ completed flips

Monthly Deal Goal: 2-5 property acquisitions

Primary Pain Point: Finding high-equity, owner-occupied properties with flip potential

Budget: $100-300/month on lead generation

Who You Are

You're an active fix-and-flip investor:

- You've completed 5+ flips (you know what you're doing)

- You're buying 2-5 properties per month

- You have capital, contractors, and systems in place

- You're looking for specific property types that fit your renovation model

- You need consistent deal flow to keep your business running

Your acquisition criteria are specific:

- Single-family homes (easier to flip than condos/multi-family)

- Under $250K purchase price (your sweet spot)

- Minimum 40-50% equity (room for renovation + profit)

- Owner-occupied preferred (more motivated to sell)

- Built 1970-2010 (easier to renovate than older or newer)

- Decent neighborhoods (buyers want to live there)

The problem: Finding properties that match ALL these criteria is hard.

Batch Leads gives you access to thousands of properties, but you're spending hours filtering to find the 10-15 that actually fit.

Why MagicList Works for You

1. The "Flip-Ready SFRs Under $250K" List

We built this list specifically for fix-and-flip operators. Every property:

- Single-family residence only

- Purchase price under $250K

- Minimum 25-40% equity (we have tiers)

- Owner-occupied (motivated sellers)

- Located in growth corridors (Mesa, Glendale, Chandler, Tempe)

- No major code violations

- Built 1970-2010 (your renovation sweet spot)

This is the list you wish Batch Leads would just give you.

2. Property Intelligence for Renovation Planning

Each property report includes:

- Square footage (plan renovation scope)

- Year built (know what you're dealing with)

- Lot size (outdoor improvement potential)

- Assessed value vs. market value (ARV estimation)

- Property tax status (current vs. delinquent)

- Neighborhood data (sales comps, market trends)

You can quickly evaluate flip potential before making a call.

3. Owner-Occupancy Flag

This is crucial for flippers: Owner-occupied properties convert at 3-4x higher rates than investor-owned properties.

Why?

- Owner-occupants are emotionally attached (motivated to avoid foreclosure)

- They're living in the problem (can't ignore it)

- They're typically one-property owners (not professional investors)

- They're more likely to accept below-market offers

MagicList flags every property's owner-occupancy status, so you can prioritize accordingly.

4. Equity Position Calculation

We calculate equity for you:

- Current market value (from assessor + comparables)

- Minus loan amount (from foreclosure filing)

- Equals equity position (dollar amount + percentage)

You instantly know:

- How much room you have for your offer

- How much renovation budget you can work with

- What your profit margin looks like

No more manual calculations or guessing.

Real Success Story: Sarah K.

Background: Fix-and-flip operator in Mesa, 2-4 flips per month

Before MagicList:

- Using Batch Leads for 18 months

- Spending $250-300/month on platform + skip tracing

- Setting the same 12 filters every single day

- Calling 100-150 leads per month

- Closing 2-3 flips per month (wanted to scale to 4-5)

After MagicList:

- Subscribed to "Flip-Ready SFRs Under $250K"

- Gets 40-60 pre-qualified properties per month

- Calling 40-60 leads per month (much more targeted)

- Closing 3-4 flips per month consistently

- Saves $150/month on data costs

Her quote: "The skip tracing alone saves me $200/month. And I'm calling leads 6 weeks before they show up on other platforms. The 'Flip-Ready SFRs' list is exactly what I need—no more filtering, just properties that fit my criteria. I've scaled from 2-3 flips per month to 3-4, and I'm working fewer hours on acquisitions."

Is This You?

You should use MagicList if:

- You have specific property criteria (SFRs under $250K, etc.)

- You're tired of setting filters daily

- You want owner-occupied properties (higher conversion)

- You need equity calculations done for you

- You're operating in Maricopa County

- You're doing 2+ flips per month (or want to)

You should NOT use MagicList if:

- You flip luxury properties ($500K+)

- You specialize in condos or multi-family

- You prefer buying at auction (we focus pre-auction)

- You operate outside Arizona

- You have very unique criteria not covered by our lists

Creative Finance Specialists

Profile Overview

Experience Level: 5+ creative finance deals

Monthly Deal Goal: 2-5 subject-to or seller finance deals

Primary Pain Point: Finding owner-occupied properties with high LTV loans

Budget: $100-200/month on lead generation

Who You Are

You're a creative finance specialist:

- You structure subject-to, seller finance, or lease-option deals

- You're not always bringing cash to close

- You're looking for motivated sellers with specific loan profiles

- You understand foreclosure timelines create urgency

- You can solve problems traditional investors can't

Your ideal seller profile:

- Owner-occupied (living in the property)

- High LTV loan (80-95% loan-to-value)

- Behind on payments (foreclosure pending)

- Wants to avoid foreclosure on their credit

- Willing to consider creative solutions

The problem: Finding these specific situations is needle-in-haystack territory.

Why MagicList Works for You

1. Owner-Occupancy + High LTV Filtering

MagicList tracks two critical data points for creative finance:

- Owner-occupancy status (owner address = property address)

- Original loan amount vs. current value (LTV calculation)

You can focus on properties where:

- Owner is living in the property (motivated to protect credit)

- Loan is 80%+ of current value (great subject-to candidate)

- Foreclosure is pending (urgency + motivation)

2. Early Warning = Relationship Building

Creative finance deals require trust. The earlier you contact a distressed seller, the more time you have to:

- Build rapport

- Educate them on options

- Structure a win-win solution

- Navigate objections

With 3-6 month early warning, you're not competing with 10 other investors in a race to close. You have time to build the relationship.

3. Loan Type Intelligence

MagicList identifies loan type when available:

- Conventional loans: Easier to assume or subject-to

- FHA/VA loans: Due-on-sale concerns, but workable

- Portfolio/Private loans: Negotiable with lender

This helps you prioritize which properties to pursue.

4. Delinquent Tax Flags

Properties with delinquent property taxes are:

- More motivated (facing multiple pressures)

- More likely to accept creative terms

- Often overlooked by cash buyers

MagicList flags delinquent tax status, giving you another layer of intelligence.

Real Success Story: David M.

Background: Creative finance specialist, 3-5 subject-to deals per month

Before MagicList:

- Using Batch Leads + manual filtering

- Spending hours identifying owner-occupied properties

- Calling 200+ leads per month

- Most were investors or vacant properties

- Hit rate: 1-2 good conversations per 100 calls

After MagicList:

- Subscribed to filtered list emphasizing owner-occupancy + high LTV

- Gets 30-50 properties per month matching his criteria

- Calling 30-50 leads per month

- Hit rate: 5-8 good conversations per 50 calls

- Closing 4-6 subject-to deals per month

His quote: "The owner-occupancy flag is gold for creative finance. I'm not wasting time calling absentee investors—I'm talking to real homeowners facing real problems. MagicList gives me the early warning to build relationships before the situation becomes desperate. My close rate has tripled."

Is This You?

You should use MagicList if:

- You specialize in creative finance strategies

- You need owner-occupied properties

- You want high LTV loan situations

- You value early contact with distressed sellers

- You're operating in Maricopa County

You should NOT use MagicList if:

- You only do cash deals

- You prefer auction purchases

- You operate outside Arizona

- You need commercial properties (we focus residential)

Buy-and-Hold Investors

Profile Overview

Experience Level: 3+ rental properties owned

Monthly Deal Goal: 1-3 property acquisitions

Primary Pain Point: Finding cash-flowing properties at discounts

Budget: $50-150/month on lead generation

Who You Are

You're building a rental portfolio:

- You own 3+ rental properties currently

- You're looking to acquire 6-12 properties per year

- You hold properties long-term (5+ years)

- You focus on cash flow and appreciation

- You're looking for distressed sellers willing to sell below market

Your acquisition criteria:

- Properties that will cash flow as rentals

- Purchase price 20-30% below market value

- Decent neighborhoods (quality tenants)

- Limited renovation needed (or budget for it)

- Room for appreciation over 5-10 years

The challenge: Finding rental-quality properties at foreclosure discounts.

Why MagicList Works for You

1. High-Equity Properties = Discount Potential

Our "High-Equity Cash Cows" list shows properties with 50%+ equity. This creates opportunity:

- Seller has room to negotiate below market

- You can offer a fair price below retail

- Property likely cash flows at your purchase price

- Built-in equity for future cash-out refi

2. Rental Market Intelligence

Each property report includes:

- Neighborhood data (rental demand indicators)

- Property specs (bedrooms, bathrooms, square footage)

- Tax assessment (estimate property taxes)

- Market value (estimate rental income via 1% rule)

You can quickly evaluate rental potential before making a call.

3. Pre-Foreclosure Timing

Buying pre-foreclosure (vs. at auction) gives you:

- More negotiation flexibility

- Ability to inspect the property

- Time for financing (if not paying cash)

- Cleaner title (less auction risk)

MagicList focuses on pre-foreclosure opportunities, which are better for buy-and-hold investors than auction purchases.

4. Lower Volume, Higher Quality

As a buy-and-hold investor, you're not doing 10 deals per month. You're doing 1-2 deals per month.

You don't need 1,000 leads. You need 20-30 really good leads.

MagicList's curated approach works perfectly for this use case.

Is This You?

You should use MagicList if:

- You're building a rental portfolio

- You want to buy below market value

- You're doing 1-3 acquisitions per month

- You focus on cash flow properties

- You're operating in Maricopa County

You should NOT use MagicList if:

- You only buy turnkey rentals at retail

- You prefer syndications over direct ownership

- You're focused on commercial real estate

- You operate outside Arizona

Small Investment Firms

Profile Overview

Experience Level: Team of 2-5 people

Monthly Deal Goal: 5-20 property acquisitions

Primary Pain Point: Team coordination and consistent deal flow

Budget: $200-500/month on lead generation

Who You Are

You run a small real estate investment firm:

- 2-5 person team (acquisitions, dispositions, admin)

- Doing 5-20 deals per month across multiple strategies

- You have systems, CRM, and processes in place

- You're looking to scale but maintain quality

- You need data that multiple team members can access

Your challenges:

- Coordinating team efforts across multiple data sources

- Maintaining consistent lead flow across channels

- Balancing cost vs. quality in lead generation

- Training new acquisitions people on systems

Why MagicList Works for You

1. Shared Access

Multiple team members can access the same lists:

- Acquisitions manager assigns A-grade leads

- Junior acquisitions reps call B-grade leads

- Follow-up specialist handles warm leads

- Everyone works from the same data source

2. Pre-Scored for Team Prioritization

A/B/C scoring enables team coordination:

- Senior reps focus on A's (highest value)

- Junior reps handle B's (learning opportunity)

- Skip C's or bulk SMS (efficiency)

This prevents duplicate calling and maximizes team productivity.

3. Consistent Deal Flow

Small firms need predictable pipelines. MagicList provides:

- Daily updates (6-hour refresh)

- Consistent volume (50-100 new properties per week)

- Predictable quality (A/B/C scoring)

- No data gaps (always fresh leads)

You can plan acquisitions capacity with confidence.

4. Download + Integrate

Export lists as CSV/Excel and import into your CRM:

- REI Sift

- Podio

- Follow Up Boss

- Custom systems

MagicList doesn't try to be your CRM—we integrate with what you already use.

Is This You?

You should use MagicList if:

- You have a team doing acquisitions

- You need consistent deal flow

- You want pre-scored leads for team prioritization

- You're doing 5-20 deals per month

- You're operating in Maricopa County

You should NOT use MagicList if:

- You're a large institutional buyer (100+ deals/month)

- You have an in-house data team

- You need API access for custom integrations

- You operate nationwide

Who MagicList Is NOT For

Let's be honest about who should probably look elsewhere:

1. Investors Outside Arizona (For Now)

Reality: We only cover Maricopa County, Arizona currently.

If you're investing in:

- California, Texas, Florida, or any other state

- Pima County (Tucson) or Pinal County (not yet launched)

- Multiple states simultaneously

What to do: Join our waitlist for expansion. We're tracking demand for other markets and will prioritize based on interest.

2. Non-Foreclosure Focused Investors

Reality: MagicList ONLY does foreclosures.

If you focus on:

- Absentee owners

- Pre-probate / probate

- Expired listings

- FSBO (For Sale By Owner)

- High-equity non-distressed sellers

- Tax liens

What to do: Use Batch Leads or PropStream. They're better suited for multi-strategy lead generation.

3. Large Institutional Buyers

Reality: MagicList is built for individual investors and small teams (1-10 people), not institutions.

If you are:

- A hedge fund buying 100+ properties per month

- A national buyer with dedicated data teams

- Looking for API access and custom integrations

- Operating across multiple states simultaneously

What to do: Build your own data pipeline or work with enterprise data providers. MagicList isn't designed for your scale.

4. Auction-Only Investors

Reality: MagicList focuses on pre-foreclosure opportunities (before auction).

If you:

- Only buy properties at trustee sales / auctions

- Don't want to contact distressed sellers directly

- Prefer competitive bidding environments

What to do: Use auction-specific platforms like Auction.com or Hubzu. MagicList is for pre-auction acquisition.

5. "Just Browsing" / Data Tourists

Reality: MagicList is built for investors who close deals, not people browsing "just in case."

If you:

- Want to see what's out there with no intent to buy

- Are researching the market with no acquisition budget

- Like browsing properties as a hobby

- Aren't ready to make calls or send offers

What to do: Wait until you're serious about closing deals. MagicList is for action-takers, not window shoppers.

6. DIY Data Scientists

Reality: MagicList is a curated solution. We do the filtering for you.

If you:

- Want access to raw data with no curation

- Prefer building your own scoring models

- Want to set 50+ custom filters

- Need complete control over every data point

What to do: Use Batch Leads or PropStream. You'll have more flexibility (and more work).

Geographic Requirements

Let's be very clear about geography:

Currently Supported

✅ Maricopa County, Arizona

This includes:

- Phoenix

- Mesa

- Chandler

- Glendale

- Scottsdale

- Tempe

- Gilbert

- Peoria

- Surprise

- Avondale

- Goodyear

- Buckeye

- And 20+ other cities in Maricopa County

Coverage: 100% of Maricopa County foreclosure filings

Coming Soon (Q2 2025)

🔜 Pima County, Arizona (Tucson)

🔜 Pinal County, Arizona (Casa Grande, Apache Junction)

On the Roadmap (2025-2026)

📋 Other non-judicial foreclosure states:

- Texas (Harris, Dallas, Tarrant counties)

- Nevada (Clark County - Las Vegas)

- California (selected counties)

- Colorado (Denver metro)

Not Planned

❌ Judicial foreclosure states (too slow, too unpredictable)

❌ Nationwide coverage (defeats our single-county depth advantage)

❌ Commercial properties (residential focus only)

Success Profiles: Real Stories

Let's look at real investor profiles and how they use MagicList:

Profile 1: The New Investor

Name: James R.

Location: Phoenix, AZ

Experience: 1 closed wholesale deal

Goal: Close 2-3 deals per quarter

Budget: $50/month

Strategy:

- Subscribed to "New Investor Bundle Under $200K"

- Gets 20-30 properties per month

- Calls 5-10 properties per week

- Focuses on A-grade leads only

Results:

- Closed first deal in 3 weeks (after subscribing)

- Average 1-2 deals per month now

- Spending 5 hours/week on acquisitions

- Confidence increased dramatically

Quote: "The A/B/C scoring made all the difference. I knew which properties to call first, and I wasn't overwhelmed by 1,000 random leads."

Profile 2: The Full-Time Wholesaler

Name: Marcus T.

Location: Phoenix, AZ

Experience: 50+ closed deals

Goal: 10-15 wholesale deals per month

Budget: $200/month

Strategy:

- Subscribed to 3 lists (High-Equity, ST Early Warning, Flip-Ready)

- Gets 100-150 properties per month across all lists

- Assigns leads to team (2 acquisitions reps)

- Prioritizes early-warning properties

Results:

- Increased deal flow from 8/month to 11/month

- Cut data management time from 15 hours/week to 30 minutes/week

- Saves $200/month on skip tracing

- Calling leads 4-6 weeks before competitors

Quote: "MagicList cut my filtering time to zero. The lists are pre-built exactly how I need them. I'm closing more deals and working fewer hours."

Profile 3: The Fix-and-Flip Operator

Name: Sarah K.

Location: Mesa, AZ

Experience: 15+ completed flips

Goal: 3-4 flips per month

Budget: $79/month

Strategy:

- Subscribed to "Flip-Ready SFRs Under $250K"

- Gets 40-60 properties per month

- Focuses on owner-occupied with 40%+ equity

- Calls all A-grades, selective on B-grades

Results:

- Scaled from 2-3 flips per month to 3-4 consistently

- Higher conversion rate (owner-occupied properties)

- Saves $150/month on data costs

- More time for project management (less time on acquisitions)

Quote: "The owner-occupancy flag is huge. I'm not wasting time calling investors—I'm talking to motivated homeowners. My conversion rate doubled."

Profile 4: The Creative Finance Specialist

Name: David M.

Location: Chandler, AZ

Experience: 20+ subject-to deals

Goal: 4-6 creative finance deals per month

Budget: $129/month

Strategy:

- Subscribed to High-Equity + Early Warning lists

- Filters for owner-occupied with high LTV

- Gets 30-50 properties per month

- Early contact (3-6 months before auction)

Results:

- Increased close rate from 1-2/month to 4-6/month

- Better conversations (more time to build trust)

- Higher quality deals (owner-occupied motivated sellers)

- Less competition (early warning advantage)

Quote: "The early warning gives me time to build relationships. I'm not racing against 10 other investors. By the time they call, I'm already under contract."

How to Know If MagicList Is Right for You

Still not sure? Here's a simple decision framework:

Ask Yourself These Questions

Question 1: Are you actively closing foreclosure deals?

- YES → Continue

- NO → Wait until you're ready to take action

Question 2: Are you operating in Maricopa County, Arizona?

- YES → Continue

- NO → Join waitlist for your area

Question 3: Are you spending 5+ hours per week filtering data on Batch Leads?

- YES → MagicList will save you 4-5 hours per week

- NO → Maybe you don't need us yet

Question 4: Are you paying $100+ per month for skip tracing?

- YES → MagicList includes free skip tracing

- NO → Cost savings may be minimal

Question 5: Do you want early access to opportunities before competitors?

- YES → 3-6 month early warning is our core advantage

- NO → You might be fine with slower platforms

Question 6: Do you prefer curated lists over infinite filtering options?

- YES → Our list model will feel like a breath of fresh air

- NO → You might prefer Batch Leads' flexibility

Question 7: Are you doing 1+ foreclosure deals per month (or want to)?

- YES → You'll get ROI immediately

- NO → Wait until your volume justifies the cost

The Decision Matrix

If you answered YES to 5-7 questions: MagicList is a perfect fit. Schedule a demo.

If you answered YES to 3-4 questions: MagicList is probably a good fit. See a sample property report first.

If you answered YES to 1-2 questions: MagicList might not be right for you yet. Join our email list for future updates.

If you answered YES to 0 questions: MagicList is definitely not right for you. Keep doing what you're doing!

Conclusion

Who is MagicList for?

MagicList is built for Arizona real estate investors who are actively closing foreclosure deals and want early access to high-equity opportunities without spending hours filtering data.

Specifically:

- ✅ New investors closing their first 1-5 deals

- ✅ Active wholesalers doing 5-15 deals per month

- ✅ Fix-and-flip operators buying 2-5+ properties per month

- ✅ Creative finance specialists working subject-to deals

- ✅ Buy-and-hold investors building rental portfolios

- ✅ Small investment firms coordinating team efforts

MagicList is NOT for:

- ❌ Investors outside Arizona (yet)

- ❌ Non-foreclosure focused strategies

- ❌ Large institutional buyers

- ❌ Auction-only investors

- ❌ Data tourists without action intent

If you're actively closing foreclosure deals in Maricopa County and you're frustrated with Batch Leads' generic approach, skip tracing costs, and endless filtering—MagicList was built for you.

Ready to see if MagicList fits your strategy?

Schedule a 15-minute demo and we'll walk through:

- Live property lists for your strategy

- A/B/C scoring in action

- Skip-traced contact data

- Which subscription makes sense for your volume

Or download a free sample property report to see what our data looks like.

About the Author

Cody Robertson is the founder of MagicList. After 15 years building technology companies and months of conversations with Arizona wholesalers and investors, he created MagicList to solve the "incredible breadth, zero depth" problem of generic real estate data platforms. Connect at hello@magiclist.agency.

Keywords for SEO: Who is MagicList for, MagicList target audience, foreclosure investing Arizona, wholesale real estate Phoenix, fix and flip leads Maricopa County, creative finance foreclosures, real estate investor tools, foreclosure lead generation, Arizona real estate investors, wholesale leads Phoenix

Meta Description: Discover who MagicList serves best: wholesalers, fix-and-flip operators, new investors, and creative finance specialists in Arizona. Complete guide to MagicList's target audience with real success stories.

Founder of MagicList and expert in Arizona real estate and foreclosure investing, passionate about helping investors discover high-equity opportunities before the competition.

Suggested Reading

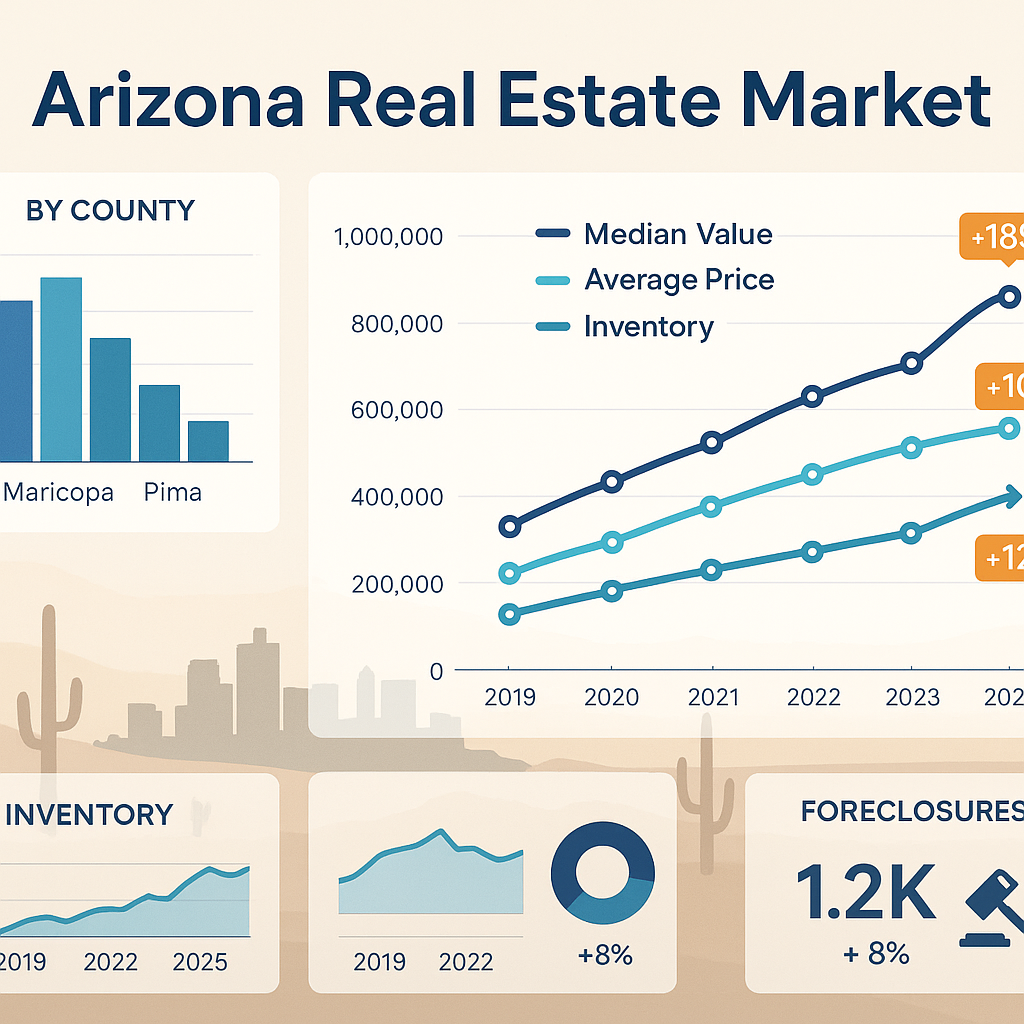

Arizona Foreclosure Market Trends in 2025

Discover the latest trends in Arizona's foreclosure market and learn how to identify high-equity opportunities before your competition.

Read article

Why We Created MagicList: The Story Behind Arizona's Foreclosure Intelligence Platform

Discover the story behind MagicList - how 15 years of building tech companies led to creating Arizona's premier foreclosure intelligence platform for real estate investors.

Read article

The Complete Guide to Skip Tracing for Real Estate Investors

Learn proven skip tracing techniques to find property owners and maximize your real estate investing success.

Read article