Why Lead Scoring Matters

Not all foreclosure opportunities are created equal. Without a systematic way to prioritize leads, investors waste time on low-quality deals while missing prime opportunities.

MagicList's AI-powered A/B/C scoring system analyzes 30+ data points to instantly qualify every foreclosure lead, helping you focus on the deals most likely to close.

The Cost of Poor Lead Qualification

Consider this scenario:

- You receive 50 foreclosure leads per week

- You spend 30 minutes researching each property

- Only 10% turn into viable opportunities

That's 25 hours per week spent mostly on dead-end leads. With proper lead scoring, you can cut that time in half while actually increasing your deal flow.

The A/B/C Scoring Framework

A-Grade Leads: Hot Opportunities

Characteristics:

- High equity position (30%+ equity)

- Recent filing (within 30 days)

- Owner-occupied property

- Clean title with minimal liens

- Strong comparable sales

- Verified contact information

Strategy: Contact immediately, make offers quickly. These leads have the highest probability of closing and typically generate the best ROI.

Example: Single-family home in Gilbert, AZ filed 15 days ago. Owner has $150K equity, verified phone number, no junior liens. Current owner struggling with medical debt.

B-Grade Leads: Solid Potential

Characteristics:

- Moderate equity (15-30%)

- Filed 30-60 days ago

- May be owner-occupied or rental

- Some title complications possible

- Decent comparable sales

- Contact information available

Strategy: Follow up consistently, build relationship. These deals require more patience but can still be profitable.

Example: Townhome in Mesa, AZ filed 45 days ago. Owner has $45K equity, rental property, small HOA lien. Worth pursuing but needs more due diligence.

C-Grade Leads: Long-Shot Opportunities

Characteristics:

- Low equity (under 15%)

- Filed 60+ days ago

- Often investment properties

- Multiple liens or title issues

- Weak market conditions

- Limited or outdated contact info

Strategy: Automated follow-up only. Don't spend significant time unless circumstances change dramatically.

Example: Condo in Tucson filed 90 days ago. Underwater by $20K, multiple junior liens, owner unresponsive. Not worth active pursuit in current market.

How MagicList Calculates Scores

Our AI analyzes these key factors:

Financial Metrics

- Current market value vs. loan balance

- Equity percentage

- Monthly payment vs. market rent

- Property tax arrears

- HOA dues status

Timing Indicators

- Days since initial filing

- Stage in foreclosure process

- Auction date proximity

- Previous bankruptcy filings

- Prior foreclosure history

Property Attributes

- Location desirability

- Property condition indicators

- Days on market for comparable

- Occupancy status

- Property type and size

Owner Situation

- Contact information quality

- Owner responsiveness history

- Bankruptcy indicators

- Divorce or estate situations

- Job loss or medical crisis signals

Using Scores Effectively

Time Allocation

Based on lead scores, structure your day:

Morning (Peak Hours):

- Call A-grade leads

- Schedule property visits

- Make offers on hot opportunities

Afternoon:

- Follow up with B-grade leads

- Conduct additional research

- Send emails and texts

Evening:

- Automated campaigns to C-grade leads

- Administrative tasks

- Market research

Conversion Optimization

Track your results by score:

- A-Grade: Target 20%+ conversion rate

- B-Grade: Target 10-15% conversion rate

- C-Grade: Target 3-5% conversion rate (via automation)

If your conversion rates are lower, adjust your approach:

- Improve your initial outreach messaging

- Refine your offer strategy

- Work on negotiation skills

- Get professional help when needed

Beyond the Score: Qualitative Factors

While AI scoring is powerful, don't ignore human factors:

Owner Motivation

A C-grade property can become an A-grade deal if:

- Owner needs to sell immediately

- Health or family crisis

- Job relocation

- Divorce settlement deadline

Market Timing

Seasonal factors affect deal quality:

- Spring/summer: More buyers, better comps

- Fall/winter: Less competition, motivated sellers

- Holiday periods: Extreme motivation or no response

Your Expertise

Play to your strengths:

- Specialize in certain property types

- Focus on specific neighborhoods

- Leverage unique financing options

- Provide creative solutions

Conclusion

Lead scoring transforms foreclosure investing from a numbers game to a strategic pursuit. MagicList's A/B/C scoring system gives you an unfair advantage—see qualified opportunities before your competition and spend your time where it matters most.

Stop chasing dead-end leads. Start closing more A-grade deals.

Founder of MagicList and expert in Arizona real estate and foreclosure investing, passionate about helping investors discover high-equity opportunities before the competition.

Suggested Reading

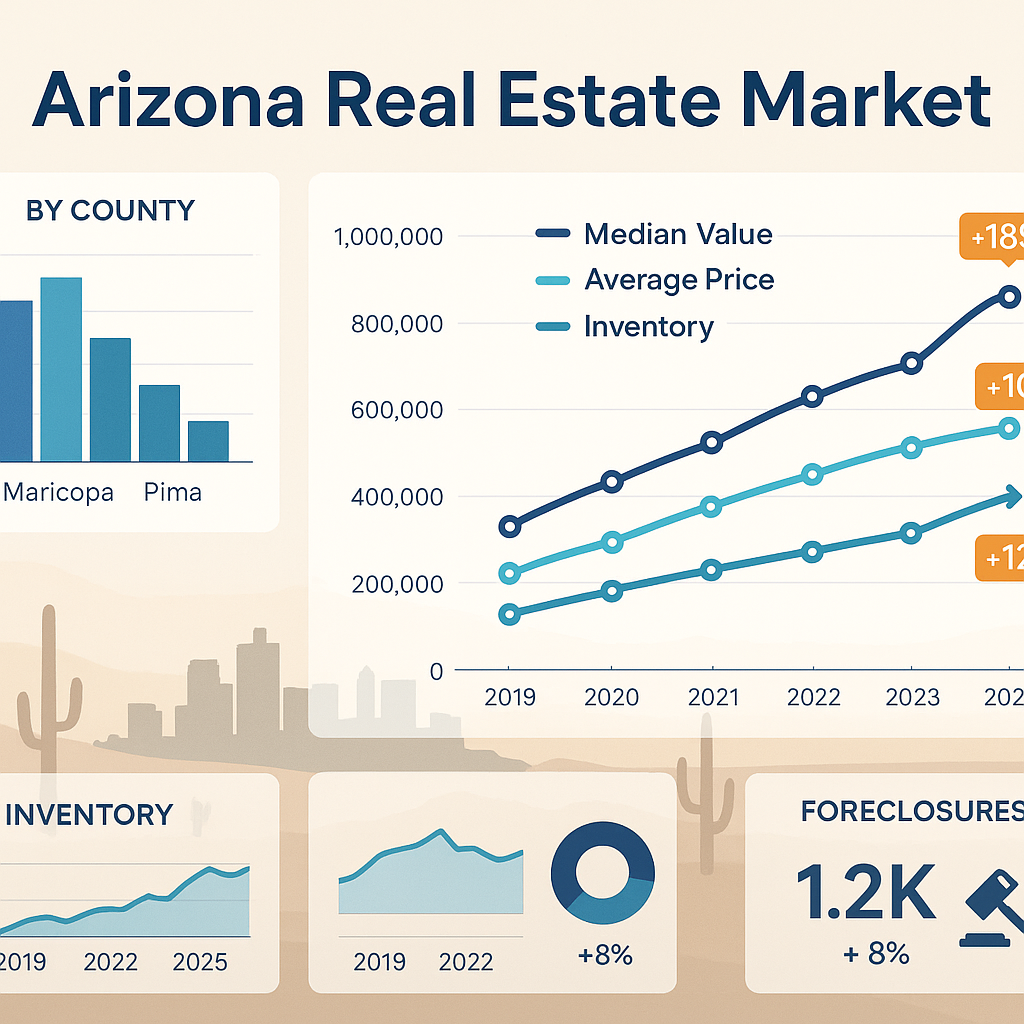

Arizona Foreclosure Market Trends in 2025

Discover the latest trends in Arizona's foreclosure market and learn how to identify high-equity opportunities before your competition.

Read article

Why We Created MagicList: The Story Behind Arizona's Foreclosure Intelligence Platform

Discover the story behind MagicList - how 15 years of building tech companies led to creating Arizona's premier foreclosure intelligence platform for real estate investors.

Read article

Who Is MagicList For? A Complete Guide to Our Target Audience

Learn who benefits most from MagicList's foreclosure intelligence platform - from new investors to active wholesalers and fix-and-flip operators in Arizona.

Read article