MagicList vs. Traditional Real Estate List Services: The Evolution of Foreclosure Intelligence

Table of Contents

- Introduction

- What Are Traditional List Services?

- The Old Way vs. The New Way

- The Five Problems with Traditional List Services

- How MagicList Solves Each Problem

- Feature-by-Feature Comparison

- Cost Analysis: Apples to Apples

- Time Investment Comparison

- Quality vs. Quantity

- Real Investor Experiences

- The Future of Lead Generation

- Which Approach Is Right for You?

Introduction

For decades, real estate investors have relied on "list services"—companies that sell spreadsheets of property data for direct mail campaigns, cold calling, and deal sourcing.

You've seen them advertised:

- "10,000 Foreclosure Leads - $299"

- "Pre-Foreclosure List - Your County - $99/month"

- "Distressed Property Data - Nationwide Coverage"

These services revolutionized real estate investing by democratizing access to property data. But they also created new problems: data quality issues, lead saturation, endless manual filtering, and unpredictable costs.

MagicList represents a fundamental shift from traditional list services to intelligent lead generation. Instead of selling you access to raw data, we deliver pre-qualified foreclosure opportunities with built-in intelligence.

This article explores the evolution from traditional list services to modern foreclosure intelligence platforms, breaking down the differences in approach, cost, quality, and results.

What Are Traditional List Services?

Traditional real estate list services follow a simple business model:

The Traditional Model

What they sell:

- Raw property data in spreadsheet format

- Lists of properties matching basic criteria

- Contact information (often requires separate skip tracing)

How they work:

- Aggregate public records from counties nationwide

- Apply basic filters (foreclosure filings, high equity, etc.)

- Package as downloadable lists

- Sell via monthly subscriptions or one-time purchases

- User is responsible for everything else (skip tracing, qualification, prioritization)

Common Traditional Services:

- ListSource

- CoreLogic Lists

- Cole Realty Resource

- Local title company list services

- County recorder "pulling services"

- Data aggregators reselling public records

The Value Proposition

What traditional services promised:

- Access to property data without visiting courthouses

- Time savings vs. manual research

- Nationwide coverage

- Affordable monthly subscriptions

What they delivered:

- Raw data (names, addresses, basic property info)

- Minimal enrichment (you get what's in public records)

- Weekly or monthly updates

- Generic nationwide approach

The Old Way vs. The New Way

Let's compare traditional list services with MagicList's intelligence platform:

Traditional List Services: The Old Way

Philosophy: "Here's the data. You figure out what to do with it."

Workflow:

- Subscribe to list service ($99-299/month)

- Download list of 5,000-10,000 properties

- Open massive spreadsheet

- Manually filter by criteria you care about

- Realize 80% don't fit your strategy

- Export 1,000 remaining properties

- Upload to skip tracing service

- Pay $150-300 for skip tracing (separate cost)

- Download skip-traced data

- Merge original list + skip trace data

- Clean data (remove duplicates, fix formatting)

- Import to dialer

- Discover 40% of phone numbers are disconnected

- Start calling the 600 remaining leads

- Realize 500 of them don't actually fit your criteria

Time investment: 4-6 hours per week

Cost: $249-599/month (platform + skip tracing)

Success rate: 10-20 good leads per 1,000 called

MagicList: The New Way

Philosophy: "We'll give you pre-qualified opportunities, not raw data."

Workflow:

- Subscribe to "Flip-Ready SFRs Under $250K" ($49-79/month)

- Log in Monday morning

- See 47 new properties added (A/B/C scored)

- Download CSV (skip tracing already included)

- Import to dialer

- Start calling (phone numbers are verified)

- Every property actually fits your criteria

Time investment: 15-30 minutes per week

Cost: $49-199/month (all-inclusive)

Success rate: 50-80 good leads per 1,000 called

The Difference:

Traditional services give you data.

MagicList gives you intelligence.

The Five Problems with Traditional List Services

Let's examine the fundamental problems with the traditional approach:

Problem #1: The Data Dump

Traditional services:

- Give you 5,000-10,000 properties per download

- No prioritization or scoring

- All leads treated equally

- You must manually identify good opportunities

The impact:

- Analysis paralysis (where do you start?)

- Time wasted reviewing properties that don't fit

- No way to prioritize calling order

- Overwhelming for new investors

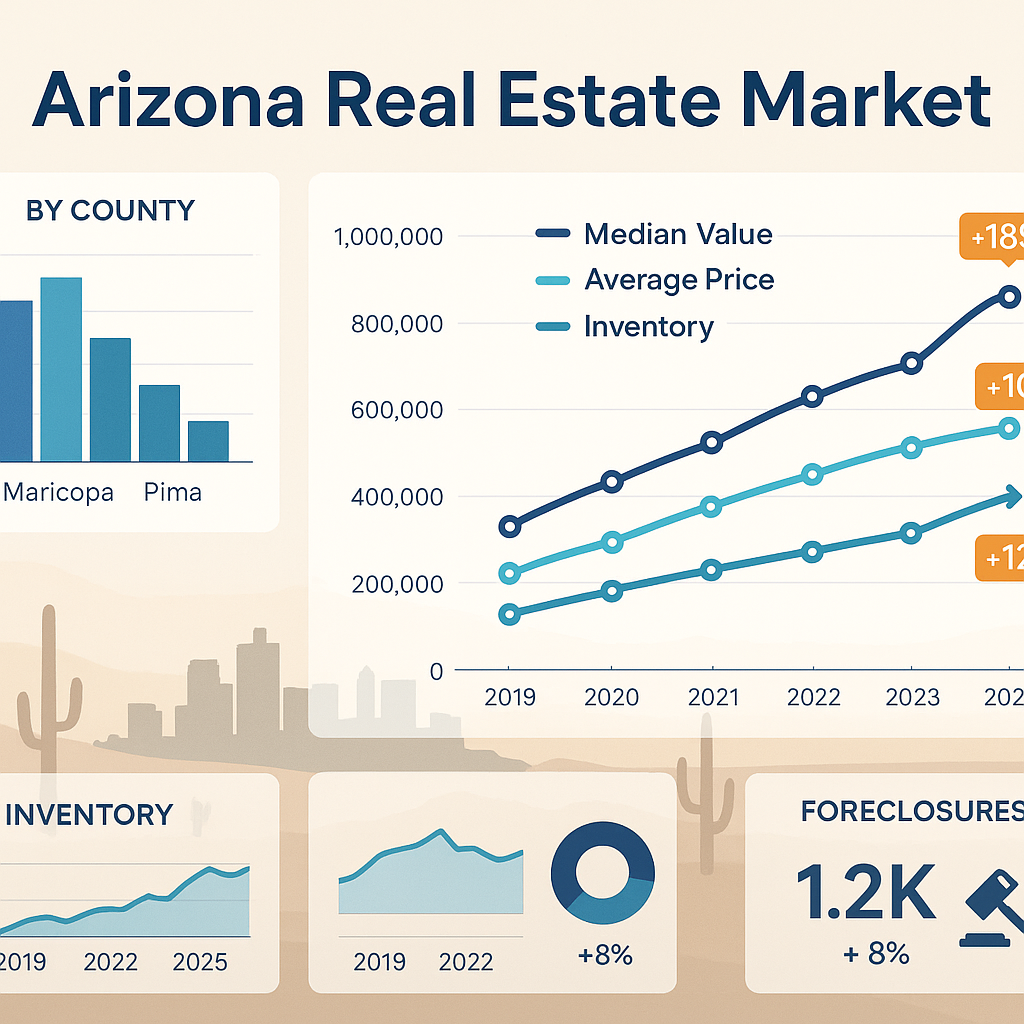

Example: You download "Arizona Foreclosures" and get 8,347 properties including:

- Manufactured homes (you don't buy these)

- Properties with $5K equity (not enough)

- Commercial properties (not your focus)

- Properties filed 3 years ago (already resolved)

- Vacant lots (not what you want)

You spend hours filtering to find the 200 that actually match your criteria.

Problem #2: Stale Data

Traditional services:

- Weekly updates (at best)

- Monthly updates (commonly)

- One-time purchases (never updated)

- Lag time of 7-30 days between filing and your download

The impact:

- You're calling leads everyone else already called

- Properties already under contract when you reach them

- Sellers have been contacted by 5-10 other investors

- No competitive advantage

Example:

- June 1: Property enters foreclosure

- June 15: List service aggregates data

- June 22: You download list

- You call: "Yes, I've talked to 8 investors already. I'm under contract."

Problem #3: The Skip Tracing Cost Trap

Traditional services:

- Provide basic contact info (if any)

- Require separate skip tracing (additional $100-400/month)

- Credit-based systems (use it or lose it)

- Quality varies wildly

The impact:

- Unpredictable costs (do you skip trace 500 or 1,000 leads?)

- Decision fatigue ("Is this lead worth $0.15?")

- Budget management headaches

- Often get disconnected numbers anyway

Example Monthly Costs:

- List service: $149/month

- Skip tracing 1,000 leads: $150-250/month

- Additional premium skip tracing for "hard to find" contacts: $50-100/month

- Total: $349-499/month (before realizing half the numbers are wrong)

Problem #4: No Quality Intelligence

Traditional services:

- Raw data only (what's in public records)

- No enrichment beyond basics

- No quality scoring or prioritization

- No equity calculations

- No owner-occupancy flags

- No motivation indicators

The impact:

- You can't distinguish between A-grade and C-grade leads

- You waste time calling low-probability opportunities

- No systematic way to prioritize

- Equal effort on unequal opportunities

Example: Two properties on your list:

Property A:

- Owner-occupied

- 55% equity

- Recent filing (30 days ago)

- Conventional loan

- All data complete

Property B:

- Investor-owned

- 15% equity

- Old filing (18 months ago)

- Missing loan information

- Partial data

Traditional list services show both identically. You call both. Property A was worth your time. Property B wasn't. But you had no way to know beforehand.

Problem #5: The "Everyone Has the Same Data" Problem

Traditional services:

- Sell the same lists to hundreds/thousands of investors

- No differentiation or competitive advantage

- Race to call first (but you're all starting from the same starting line)

- Saturated leads

The impact:

- Sellers are overwhelmed by calls from investors

- "I've already talked to 10 people like you"

- Price competition drives margins down

- Difficult to build rapport (seller is burned out)

Example: Monday morning, a list service releases their weekly Arizona foreclosures update.

- 500 investors download it

- 500 investors start calling the same 2,000 properties

- By Wednesday, sellers have been called 5-10 times

- By Friday, the best opportunities are gone

You're competing on speed alone, not intelligence.

How MagicList Solves Each Problem

Let's see how MagicList's approach addresses each of these fundamental problems:

Solution #1: Curated Lists, Not Data Dumps

Instead of 10,000 generic properties, we give you 50-100 properties that:

- Match your specific strategy

- Are pre-filtered by proven criteria

- Are A/B/C scored for quality

- Are updated continuously (not dumped weekly)

The MagicList lists:

"Flip-Ready SFRs Under $250K"

- Single-family only

- Under $250K purchase price

- 25-40% equity minimum

- Owner-occupied preferred

- Growth corridors

- No major code violations

"High-Equity Cash Cows (50%+ Equity)"

- 50%+ equity positions

- All property types

- Owner-occupied flagged

- Delinquent tax indicators

- Market value $150K-$500K

"New Investor Bundle Under $200K"

- Under $200K (manageable first deals)

- 30%+ equity

- Clear title (no complex liens)

- Recent filings (hot leads)

"Pre-Pre-Foreclosure Early Warnings"

- Predictive models (6-12 months early)

- High LTV + delinquent taxes

- Code violations

- USPS vacancy indicators

"Substitution of Trustee - 45 Day Heads Up"

- ST filed in last 7 days

- Leads to NTS within 45 days typically

- 20%+ equity minimum

- Active homeowners (not vacated)

The impact:

- No analysis paralysis (50 properties vs. 10,000)

- Every property fits your criteria (no wasted time)

- Clear prioritization (A/B/C scoring)

- Actionable immediately (not overwhelming)

Solution #2: Real-Time Updates (Every 6 Hours)

Instead of weekly data dumps, we poll Maricopa County Recorder every 6 hours:

- New filings appear within hours

- 4 updates per day (vs. 1 per week)

- Fresh leads before competition sees them

- Continuous feed vs. batch delivery

The competitive advantage:

Traditional List Service Timeline:

- Monday: Foreclosure filed

- Monday: Data aggregated (7-day lag)

- Next Monday: List released to 500 investors

- Next Monday: You download and start calling

- Total lag: 7-14 days

MagicList Timeline:

- Monday 9am: Foreclosure filed

- Monday 3pm: MagicList update cycle detects it

- Monday 3:15pm: Property enriched and scored

- Monday 3:30pm: Appears in your list

- Monday afternoon: You call

- Total lag: 6 hours

The difference: You're calling 7-14 days before investors using traditional list services see the same property.

Solution #3: FREE Unlimited Skip Tracing

Instead of paying $0.10-0.30 per lead, all properties come skip-traced:

- Phone numbers (mobile + landline)

- Email addresses

- Mailing addresses

- Owner names

- No per-lead fees

- No credit systems

- No budget decisions

The cost impact:

Traditional services (1,000 leads/month):

- List service: $149/month

- Skip tracing: $200/month

- Total: $349/month

MagicList (1,000 leads/month):

- 3-List Bundle: $129/month

- Skip tracing: $0 (included)

- Total: $129/month

Savings: $220/month = $2,640/year

The predictability: No more "should I skip trace these 100 leads?" decisions. Every property is skip-traced automatically. Your costs are fixed and predictable.

Solution #4: A/B/C Quality Intelligence

Instead of raw data, every property is scored across 5 dimensions:

Dimension 1: Equity Percentage

- 50%+ equity: 100 points

- 40-50% equity: 80 points

- 30-40% equity: 60 points

- 20-30% equity: 40 points

Dimension 2: Owner-Occupancy

- Owner-occupied: 100 points (motivated)

- Non-owner: 50 points

- Unknown: 25 points

Dimension 3: Loan Type

- Conventional: 100 points (easier)

- FHA/VA: 80 points

- Portfolio/Private: 60 points

Dimension 4: Recency

- Filed within 7 days: 100 points (hot)

- Filed 8-30 days: 80 points

- Filed 31-60 days: 60 points

Dimension 5: Data Quality

- Complete (all 28 fields): 100 points

- Mostly complete (20-27): 80 points

- Partial (15-19): 60 points

Composite Score:

- A-Grade: 400+ points (top 20% - call immediately)

- B-Grade: 300-399 points (solid opportunities)

- C-Grade: 200-299 points (call if you have time)

The workflow impact:

Without scoring (traditional services):

- Call all 1,000 leads equally

- Waste time on low-quality leads

- No systematic prioritization

- Success rate: 10-20 good conversations per 1,000 calls

With A/B/C scoring (MagicList):

- Call 200 A-grades first (highest probability)

- Call 300 B-grades next (solid opportunities)

- Skip or bulk-SMS 500 C-grades (low priority)

- Success rate: 50-80 good conversations per 1,000 calls

The impact: 3-4x better use of calling time

Solution #5: Early-Warning Intelligence (3-6 Month Advantage)

Instead of seeing properties when everyone else does, you get early warning:

Substitution of Trustee Tracking:

- ST filings typically occur 45 days before NTS

- We alert you immediately when ST is filed

- You call before NTS is even filed

- Traditional list services don't track ST at all

Predictive Pre-Foreclosure Models:

- Machine learning identifies properties likely to enter foreclosure

- 6-12 months before first filing

- Based on signals like:

- Delinquent property taxes (2+ quarters)

- High LTV loans (80-95%)

- Code violations

- USPS vacancy indicators

- Call distressed sellers before foreclosure process starts

The competitive advantage:

Traditional List Services:

- Month 4: Notice of Trustee Sale filed

- Month 4: All investors see it simultaneously

- Month 4-5: Race to call first

- Month 6: Property goes to auction

MagicList Early Warning:

- Month 1: Predictive model flags high-risk property

- Month 2: Substitution of Trustee filed → Alert sent

- Month 2-3: You call, build relationship

- Month 4: NTS filed → Traditional list services see it now

- Month 5: You already have it under contract

The result: You're having conversations 3-6 months before your competition knows the property exists. This isn't about calling faster—it's about calling earlier.

Feature-by-Feature Comparison

| Feature | Traditional List Services | MagicList |

|---|---|---|

| Data Updates | Weekly/monthly | Every 6 hours (4x daily) |

| List Size | 5,000-10,000 properties | 50-100 curated properties |

| Skip Tracing | $0.10-0.30 per lead | FREE unlimited |

| Quality Scoring | None | A/B/C across 5 dimensions |

| Early Warning | No (when filed = when you see it) | Yes (3-6 months early) |

| Enrichment Coverage | 40-60% | 87% |

| Owner-Occupancy Flag | Rarely | Always |

| Equity Calculation | You calculate manually | Pre-calculated |

| Filtering Required | Hours per week | None (pre-filtered) |

| Prioritization | Manual (all leads equal) | Automatic (A/B/C tiers) |

| Geographic Coverage | Nationwide | Maricopa County, AZ |

| Foreclosure Specialization | Generic | Deep (foreclosures only) |

| Learning Curve | 2-4 hours | 5 minutes |

| Weekly Time Investment | 4-6 hours | 15-30 minutes |

Cost Analysis: Apples to Apples

Let's compare the all-in costs:

Traditional List Service (1,000 leads/month)

Monthly Costs:

- List service subscription: $149/month

- Skip tracing (1,000 leads @ $0.20): $200/month

- Premium skip tracing for "hard to find": $50/month

- List cleaning service (remove duplicates): $20/month

- Total: $419/month

Annual Cost: $5,028

MagicList (1,000 leads/month)

Monthly Costs:

- 3-List Bundle subscription: $129/month

- Skip tracing: $0 (included)

- List cleaning: $0 (not needed)

- Total: $129/month

Annual Cost: $1,548

Savings: $3,480/year (69% cost reduction)

Traditional List Service (2,500 leads/month - High Volume)

Monthly Costs:

- List service subscription (higher tier): $249/month

- Skip tracing (2,500 leads @ $0.20): $500/month

- Premium skip tracing: $100/month

- List cleaning service: $50/month

- Total: $899/month

Annual Cost: $10,788

MagicList (2,500 leads/month - High Volume)

Monthly Costs:

- All-Access subscription: $199/month

- Skip tracing: $0 (included)

- List cleaning: $0 (not needed)

- Total: $199/month

Annual Cost: $2,388

Savings: $8,400/year (78% cost reduction)

Time Investment Comparison

Beyond direct costs, there's the hidden cost of time:

Traditional List Services - Weekly Workflow

Monday (2 hours):

- Download weekly list

- Open spreadsheet with 8,000 properties

- Apply filters to find properties matching criteria

- Identify 1,200 potential properties

- Export to new spreadsheet

Tuesday (1.5 hours):

- Upload to skip tracing service

- Purchase skip tracing credits

- Run skip tracing on 1,200 properties

- Download results

- Merge original data + skip trace data

Wednesday (1 hour):

- Clean data (remove duplicates, fix formatting)

- Identify and remove properties with no contact info

- Manually calculate equity positions

- Flag owner-occupied properties (if data available)

Thursday (30 minutes):

- Import to dialer

- Set up calling campaign

- Brief team on list

Weekly Total: 5 hours of data management

Monthly Total: 20 hours of data management

Annual time cost:

- 240 hours per year

- At $50/hour value: $12,000

- At $100/hour value: $24,000

MagicList - Weekly Workflow

Monday (15 minutes):

- Log into MagicList

- Review "Flip-Ready SFRs Under $250K"

- See 47 new properties (A/B/C scored, skip-traced)

- Download CSV

- Import to dialer

- Start calling

Weekly Total: 15 minutes of data management

Monthly Total: 1 hour of data management

Annual time cost:

- 12 hours per year (vs. 240 hours with traditional)

- Time savings: 228 hours per year

Value of time saved:

- At $50/hour: $11,400/year

- At $100/hour: $22,800/year

Quality vs. Quantity

The fundamental difference in philosophy:

Traditional List Services: Quantity Approach

Philosophy: "Give users more data. Let them find the gems."

Metrics:

- 5,000-10,000 properties per download

- 40-60% enrichment coverage

- No quality scoring

- Everyone gets the same data

Results:

- 98% of properties don't fit your criteria

- Hours spent filtering

- Low conversion rates

- Saturated leads (everyone calling same properties)

Success rate:

- 1,000 leads called

- 50-100 connections made

- 10-20 actual qualified conversations

- 1-2 deals closed

- Conversion: 0.1-0.2%

MagicList: Quality Approach

Philosophy: "Give users pre-qualified opportunities. No filtering needed."

Metrics:

- 50-100 properties per list

- 87% enrichment coverage

- A/B/C quality scoring

- Early-warning intelligence

Results:

- 95%+ of properties fit your criteria

- Zero time filtering

- Higher conversion rates

- Fresh leads (3-6 months before competition)

Success rate:

- 200 leads called (A-grades only)

- 80-120 connections made

- 50-80 actual qualified conversations

- 3-5 deals closed

- Conversion: 1.5-2.5%

10x better conversion rate through quality over quantity.

Real Investor Experiences

Investor #1: Marcus T. (Phoenix Wholesaler)

Before (Traditional List Service):

- Spending $400/month (list service + skip tracing)

- 15 hours/week on data management

- Calling 1,500 leads/month

- Closing 6-8 deals/month

- Frustrated with "everyone calls the same leads"

After (MagicList):

- Spending $129/month (3-List Bundle)

- 30 minutes/week on data management

- Calling 800 leads/month (but higher quality)

- Closing 10-12 deals/month

- Early warning means less competition

Results:

- $271/month saved ($3,252/year)

- 14.5 hours/week saved (58 hours/month)

- 50% increase in deal volume

- Less frustration, better conversations

His quote:

"I was drowning in data from my old list service. 8,000 properties every week, and I'd spend hours trying to find the 200 that actually mattered. MagicList gives me exactly what I need—no more, no less. And I'm calling leads before anyone else even knows they exist."

Investor #2: Sarah K. (Mesa Fix-and-Flip)

Before (Traditional List Service):

- Spending $300/month (list service + premium skip tracing)

- 12 hours/week filtering for her specific criteria

- Calling 200 leads/month

- Closing 2-3 flips/month

- Manual equity calculations for every property

After (MagicList):

- Spending $79/month (Flip-Ready SFRs list)

- 20 minutes/week on list management

- Calling 150 leads/month (all pre-qualified)

- Closing 3-4 flips/month consistently

- Equity pre-calculated, owner-occupancy flagged

Results:

- $221/month saved ($2,652/year)

- 11 hours/week saved (44 hours/month)

- 33% increase in deal volume

- Higher conversion rate (better targeting)

Her quote:

"The 'Flip-Ready SFRs Under $250K' list is literally exactly what I need. Every property fits my criteria—SFR, under $250K, owner-occupied, decent equity. I used to spend 12 hours a week trying to recreate this list manually from generic data. Now it just shows up every 6 hours."

Investor #3: James R. (New Investor)

Before (Traditional List Service):

- Spending $200/month (budget list service + skip tracing)

- Overwhelmed by data (5,000 properties to review)

- Didn't know where to start

- Paralysis by analysis (spent 3 months "researching")

- Zero deals closed

After (MagicList):

- Spending $49/month (New Investor Bundle)

- Gets 20-30 properties perfectly suited for beginners

- A/B/C scoring tells him where to start

- Started calling within 3 days of subscribing

- Closed first deal in 3 weeks

Results:

- $151/month saved ($1,812/year)

- Eliminated analysis paralysis

- First deal closed (would not have happened otherwise)

- Confidence to continue investing

His quote:

"As a new investor, I was completely lost with traditional list services. 5,000 properties? How do I even start? MagicList gave me 22 properties, all under $200K, all with good equity, all scored A/B/C. I called the A's first. Third conversation led to my first deal. I would still be 'researching' if I hadn't found MagicList."

The Future of Lead Generation

The evolution from traditional list services to intelligent platforms like MagicList represents a broader trend in real estate investing:

The Past: Data Access Era (2000-2020)

Bottleneck: Access to data

Solution: List services that aggregate public records

Value: Convenience (download lists vs. visit courthouses)

The Present: Data Intelligence Era (2020-present)

Bottleneck: Too much data, not enough intelligence

Solution: Intelligent platforms with scoring, enrichment, and curation

Value: Quality over quantity (pre-qualified vs. raw data)

The Future: Predictive Intelligence Era (2025+)

Bottleneck: Everyone has the same data

Solution: Predictive models, early-warning systems, proprietary signals

Value: Competitive advantage (see opportunities 6-12 months early)

MagicList is built for the present and future, not the past.

Which Approach Is Right for You?

Choose Traditional List Services If:

✅ You invest nationwide (not just Arizona)

✅ You need multiple list types (foreclosures, absentee, probate, etc.)

✅ You have a data analyst on your team who loves filtering

✅ You want the cheapest option (even if it requires more time)

✅ You're operating in markets where specialized services don't exist

✅ You have existing workflows optimized around traditional lists

Best for: Nationwide operators, multi-strategy investors, data-driven analysts, budget-conscious investors willing to trade time for money

Choose MagicList If:

✅ You invest in Maricopa County, Arizona

✅ You focus exclusively on foreclosures

✅ You want to save 10-20 hours per week on data management

✅ You want to save $2,000-8,000 per year on list + skip tracing costs

✅ You value early-warning competitive advantage (3-6 months)

✅ You're an action-taker who wants to dial, not filter

✅ You want higher conversion rates through quality over quantity

✅ You're frustrated with traditional list service limitations

Best for: Arizona foreclosure investors, time-conscious wholesalers, fix-and-flip operators, new investors, cost-conscious operators, efficiency seekers

Conclusion: The Case for Specialized Intelligence

The question isn't really "MagicList vs. traditional list services."

The question is: "Do you want data or intelligence?"

Traditional list services give you data:

- Massive spreadsheets

- Raw information from public records

- Generic nationwide approach

- You do all the work (filtering, skip tracing, prioritization)

MagicList gives you intelligence:

- Curated opportunities matching your strategy

- Pre-qualified, skip-traced, and scored

- Deep Arizona specialization

- We do the work (you just call and close)

The evolution is inevitable:

Just as investors moved from:

- Visiting courthouses → Downloading lists (2000s)

- Downloading lists → Using intelligent platforms (2020s)

The future belongs to platforms that provide intelligence, not just access.

For Arizona foreclosure investors, the choice is clear:

- Save $2,000-8,000 per year

- Save 10-20 hours per week

- Get 3-6 months early warning

- Close more deals with less effort

That's not a pitch. That's math.

Ready to evolve beyond traditional list services?

Schedule a 15-minute demo where we'll show you:

- Side-by-side comparison of traditional lists vs. MagicList intelligence

- Real cost analysis (including time savings)

- Live A/B/C scoring in action

- Early-warning intelligence examples

- Which subscription makes sense for your volume

Or download a free sample property report to see the difference between raw data and intelligent leads.

About the Author

Cody Robertson is the founder of MagicList. After watching Arizona investors waste hours filtering generic list service data, he built MagicList to provide intelligent foreclosure opportunities—not raw data dumps. His mission: save investors time and money while giving them competitive advantages through early-warning intelligence. Connect at hello@magiclist.agency.

Keywords for SEO: MagicList vs list services, real estate lead generation, foreclosure list services, traditional lead lists, intelligent lead generation, Arizona foreclosure leads, property data comparison, wholesale leads, skip tracing costs, real estate investor tools, foreclosure intelligence, lead quality vs quantity

Meta Description: Traditional list services vs. MagicList: Discover why intelligent foreclosure leads outperform raw data dumps. Save $2,000-8,000/year, 10-20 hours/week, and get 3-6 months early warning on Arizona foreclosures.

Founder of MagicList and expert in Arizona real estate and foreclosure investing, passionate about helping investors discover high-equity opportunities before the competition.

Suggested Reading

Arizona Foreclosure Market Trends in 2025

Discover the latest trends in Arizona's foreclosure market and learn how to identify high-equity opportunities before your competition.

Read article

Why We Created MagicList: The Story Behind Arizona's Foreclosure Intelligence Platform

Discover the story behind MagicList - how 15 years of building tech companies led to creating Arizona's premier foreclosure intelligence platform for real estate investors.

Read article

Who Is MagicList For? A Complete Guide to Our Target Audience

Learn who benefits most from MagicList's foreclosure intelligence platform - from new investors to active wholesalers and fix-and-flip operators in Arizona.

Read article